Retirement Risk #7: Rising Expenses (Inflation) — Powerful Enough to Erode Retirement

Why Even Small Inflation Rates Deserve Retirees’ Attention

These uncertain and unprecedented times we’re currently in leave many question marks surrounding inflation and other economic factors that could impact life for all of us — especially retirees.

In recent months, some grocery prices skyrocketed at a rate that hasn’t been seen in over 40 years.

Some experts believe inflation is more of a risk to retirees maintaining their standard of living than market corrections. Whether you agree or disagree with that viewpoint, inflation should be considered when planning for retirement.

“Inflation is ever-present in retirement. Something as simple as going to the store to buy a gallon of milk can remind us of constant price increases while our income is either uncertain or fixed.”

— Eric Stratton, Heyday founder

Unpredictable, Yet Powerful

While inflation is unpredictable, a small percentage increase can impact those on a fixed income by eroding their purchasing power. Even a modest rate of inflation could cut a retiree’s spending power enough to make an impact.

Since the end of World War II, our average annual inflation rate has been 3.8%, with yearly rates varying (sometimes wildly). However, only a 3% inflation rate could cut a retiree’s purchasing power in half in 24 years.

For someone retiring at 65 today, they could very likely live to over 90. If inflation chopped their purchasing power in half in 24 years, by 89 they could find themselves in financial trouble.

Inflation Drives Social Security Cost of Living Adjustments (COLA)

Thankfully, some retirement income sources account for inflation. Depending on the economic situation, Social Security recipients may receive a cost of living adjustment (COLA). The Kiplinger Letter forecasts a 1.2% COLA increase for 2021.

While that may be good news at first glance, retirees should consider other approaches to offset inflation. Especially when goods may rise faster than COLA increases.

According to The Senior Citizens League’s 2019 Social Security Loss of Buying Power Study, Social Security benefits have lost 33% of their buying power between 2000 and 2019.

The study found while COLA benefits during the 19-year period increased benefits by 50%, the typical goods and services retirees purchased rose at a rate more than double — 100.3%.

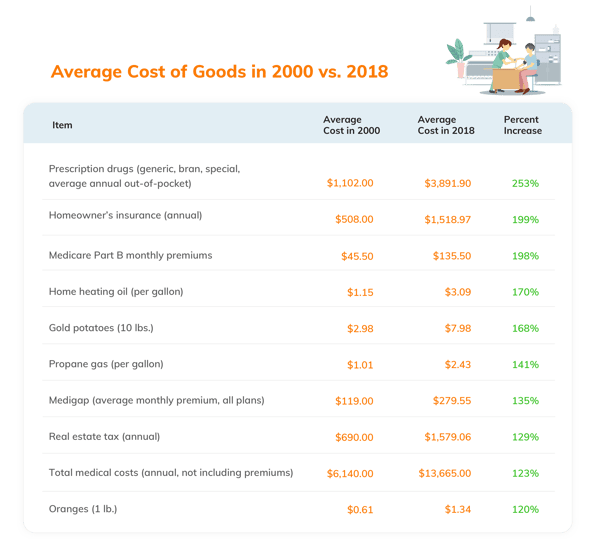

The Senior Citizens League also reported the top 10 fastest-growing costs for older Americans since 2000 were.

While historical data cannot predict how costs may rise or fall throughout retirement, they can provide a snapshot of how significantly prices can change over time.

How Pre-Retirees and Retirees May Handle Inflation

Inflation has the power to influence costs of everything from food and fuel to car insurance and health care. And in the midst of these uncertain times, experts can’t seem to agree on whether inflation will go up or down.

Combined, all of these factors can make it difficult to imagine enjoying retirement as planned for those who are right there at the end of their careers.

Pre-retirees and retirees may try to offset future inflation by:

Delaying retirement - some retirees may push back their retirement date as long as possible. While this approach can provide opportunities to grow their savings and potentially increase their Social Security benefits by waiting longer, there could be trade-offs. The early years of retirement are often the most active, when a couple has the mobility and energy to take those trips, make new memories and enjoy the fruits of their lifetime of labor. Sometimes, those postponed plans end up never taking place due to health or other reasons, and time spent working leaves little for vacations.

Retiring but only spending money on bills - cutting out discretionary spending early on can lead to a retirement that feels like a disappointment. Savings will last longer without discretionary spending, but retirees could run into the same risks as delaying retirement — losing valuable, mobile time for trips and fun activities.

Take on debt to accommodate price increases - when the costs of goods exceed the monthly budget and retirement income, retirees may need to borrow money for essentials. However, this method probably isn’t sustainable and could cost much more in the long run due to interest paid and additional monthly bills.

Spend more from retirement savings - if retirees are challenged with bills that cost more than their retirement income and withdrawals, they may resort to taking additional withdrawals from their nest eggs. However, these payouts could impact overall earning potential and may have tax implications. Consulting with a tax professional is recommended prior to making any additional withdrawals.

For many of us, none of these options will be ideal after working toward retirement for decades.

To help address these risks head-on, retirees and pre-retirees can take advantage of online assessments like Heyday’s Custom Retirement Review. By answering a few simple questions, they can see how their nest egg may hold up against common risks they’re concerned about facing.

Try Heyday’s online risk assessment for free here.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.

.jpg)