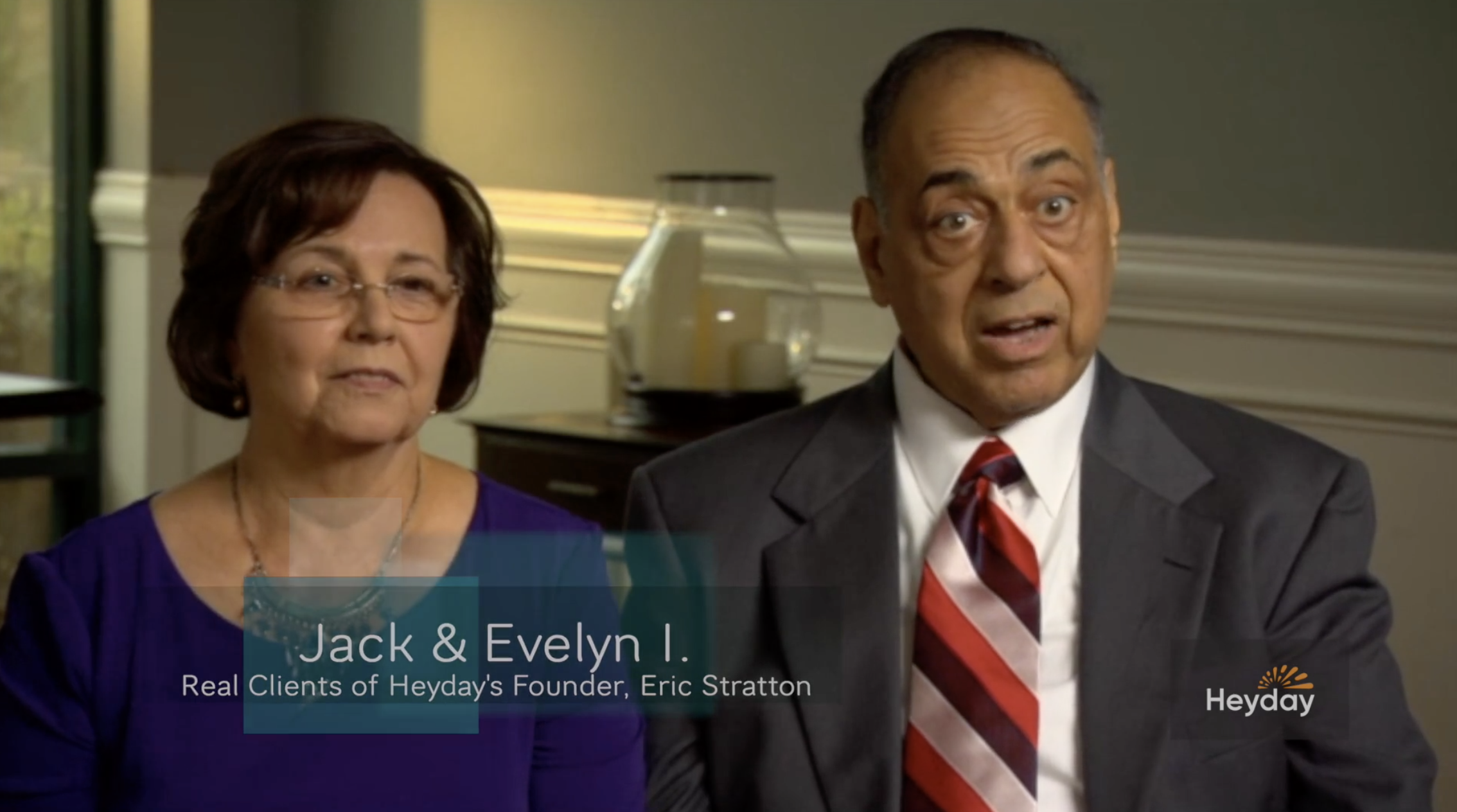

client of Heyday’s founder, Eric Stratton

David was advised that his temperament suited the solitary careers of a long-distance truck driver or a forest ranger. Taking the 'travel or trees’ suggestion to heart, he earned a Bachelors degree in Paper Industry Science and Engineering and an MBA, both at Miami University in Oxford, Ohio. After a stint in the US Army, David spent more than three decades working as a roaming consulting engineer, racking up thousands of frequent flyer miles visiting pulp and paper production plants and managed woodlands across North America and around the world, focusing upon conservation and efficiency projects making his high school guidance counselor right on both counts.

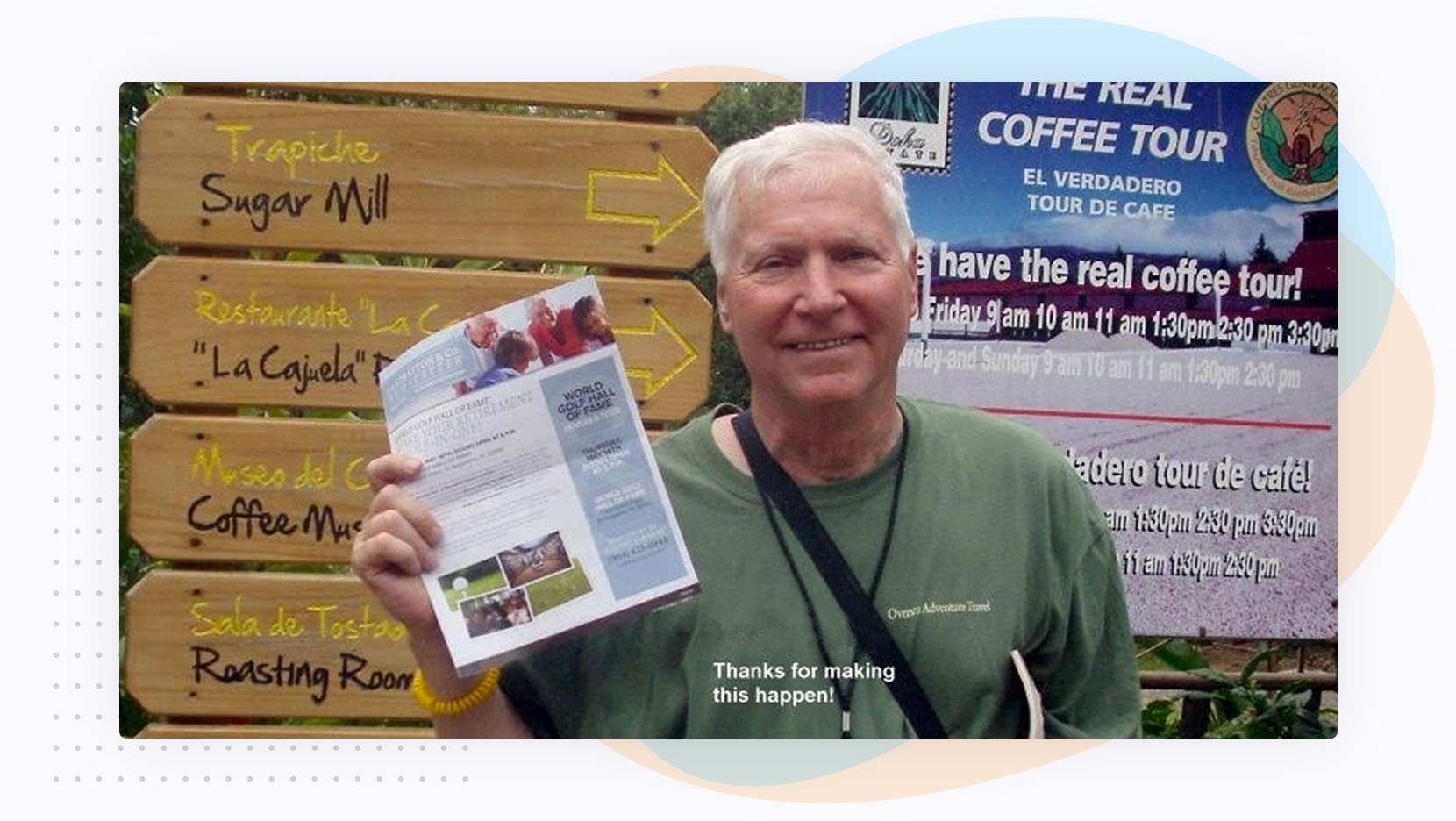

Since his retirement in 2008 at age 62, David has switched travel gears from business to pleasure. He is now a regular international traveler with a passport full of entry visa stamps from Costa Rica, Vietnam, Great Britain, China, France, Croatia, and 40 or so more (including a special visa stamp from Machu Picchu in Peru). He shares some of his and wife Susan's experiences traveling in retirement, and how retirees can budget for travel.

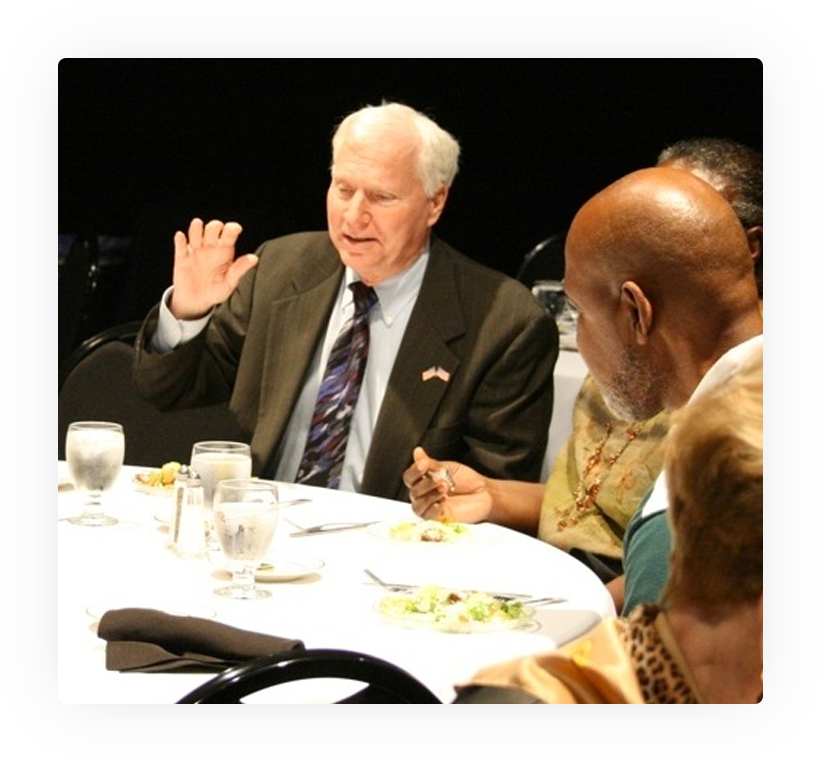

We’d like to thank David for doing this interview. He and his wife, Susan, are longtime clients and great friends Eric Stratton and everyone at Heyday. David is one of the most active travelers we know, and we asked him to share some of his experience and travel insights especially suited for retirees who are looking to hit the road. He shares some of his and wife Susan's experiences traveling in retirement, and how retirees can budget for travel:

“I think the first time you visit a place, it’s important to have something organized, whether it’s a tour, or a tour guide, or just a local friend who can put you in the right direction. There’s a lot you can miss, wasting time with a map. And there’s usually plenty of time to wander off by yourself afterwards.

I use the Berlitz 30-day language courses to pick up essential phrases and interactions before visiting a new country, and I took a Spanish-language course through our church that got me comfortable enough that I can communicate without the lag of internally translating the conversation into English and back into Spanish.

If you can’t communicate with the locals, you lose so much of what a destination has to offer. Some people are shy about trying to speak a foreign language to a native speaker, but in my experience it’s pretty universal that they’ll appreciate your effort. A lot of places, people want to practice their English too, so it all works out.

If you’re even thinking about international travel, get prepared now. You never know when an unexpected opportunity (a last-minute tour discount or a friend’s cancelled cruise) might come along, so you should have your passport renewed and ready. We’ve had some great trips that started with a snap decision, but if we had to wait for a passport we’d have missed out. That said — keep an open mind. You might be thinking about a Sicilian countryside vacation and then hear about a great deal on a small tour through South America. It could be the trip of a lifetime! And once you’re traveling, keep some time open for lesser-known opportunities. I’ve had a great time at neighborhood soccer games, at a Costa Rican rodeo, at a Parisian dinner show, and on a horse-whisperer’s farm!

I can count on one hand the number of years I earned more than $50,000 in my life. And working with Eric Stratton (Heyday’s founder), I have money to pay the bills and do extra stuff. And I'm making more money now with my annuities than I ever made working. They’ve done a good job getting the money to where I can do the fun things and not have to worry about the expense. I was good at saving not great at getting a high paying job and making a lot of money, but I was good at saving.

Eric and the people here have made it so that I’m making… well, what I think is good money. It’s more than I need. It’s how I can take trips. I can look at it and say, Unless there’s a financial crisis for the whole world, I would have difficulty running out of money before I die. And that is so stress-free…it really is amazing how different you feel where if something happens, you can pay for it. There’s enough money to pay for living, and extras. And that’s very pleasant that’s the reason to come to here, really.”

Use this free tool to see how unexpected expenses and events may impact your retirement income and savings, and how to prepare for them.

BOOK YOUR APPOINTMENTSee what some of the clients of Heyday — retirees of all backgrounds and futures —have to say about working with our experienced, helpful team.

Since we’ve been here, we’re so much more relaxed. No matter what the market does, we can sleep at night, and not worry.

They were nice! They called me back, and when we met, I really liked the way they spoke!

I was impressed about how open and relaxed the whole meeting was.

I have friends I’ve sent over here. They were struggling with their finances.

Heyday's free tool calculates the cost of unexpected retirement expenses, and when they may happen.

BOOK YOUR APPOINTMENT

Heyday Retirement is a premier source for comprehensive tools and informative content designed to help retirees secure a custom retirement income plan. This plan can be the foundation for living out the retirement of their dreams — a retirement that is truly their Heyday! Learn More

How much does the Heyday app cost?

The Heyday app is completely free. There are no monthly fees or signup fees; no credit card is required. This means you can create a full retirement income plan in Heyday and pay nothing unless you decide to purchase some or all of the insurance products suggested in the plan.

Materials offered by Heyday Retirement, including articles, ebooks, and workshops are designed to provide general information on the subjects covered. They are not intended to provide specific financial, legal or tax advice. Heyday markets insurance products and its representatives do not give investment, legal or tax advice. You are encouraged to consult your tax advisor, attorney, or investment advisor.

By providing your information, you give consent to be contacted by a licensed insurance professional about the possible sale of an insurance product. Pay nothing unless you decide to purchase some or all of the insurance products suggested in the plan. You may withdraw your consent at any time.

All Heyday authors, professors and educators are paid for their contributions. Their inclusion does not represent an endorsement of products.

Copyright 2022 Heyday. All rights reserved.