Heyday Founder and President

Executive Vice President, Education

Executive Vice President

Vice President, Support

Heyday provides personalized solutions for retirees and pre-retirees who:

Throughout the years, we perfected the strategies we use to help clients minimize risk and maximize enjoyment with guaranteed lifetime income.

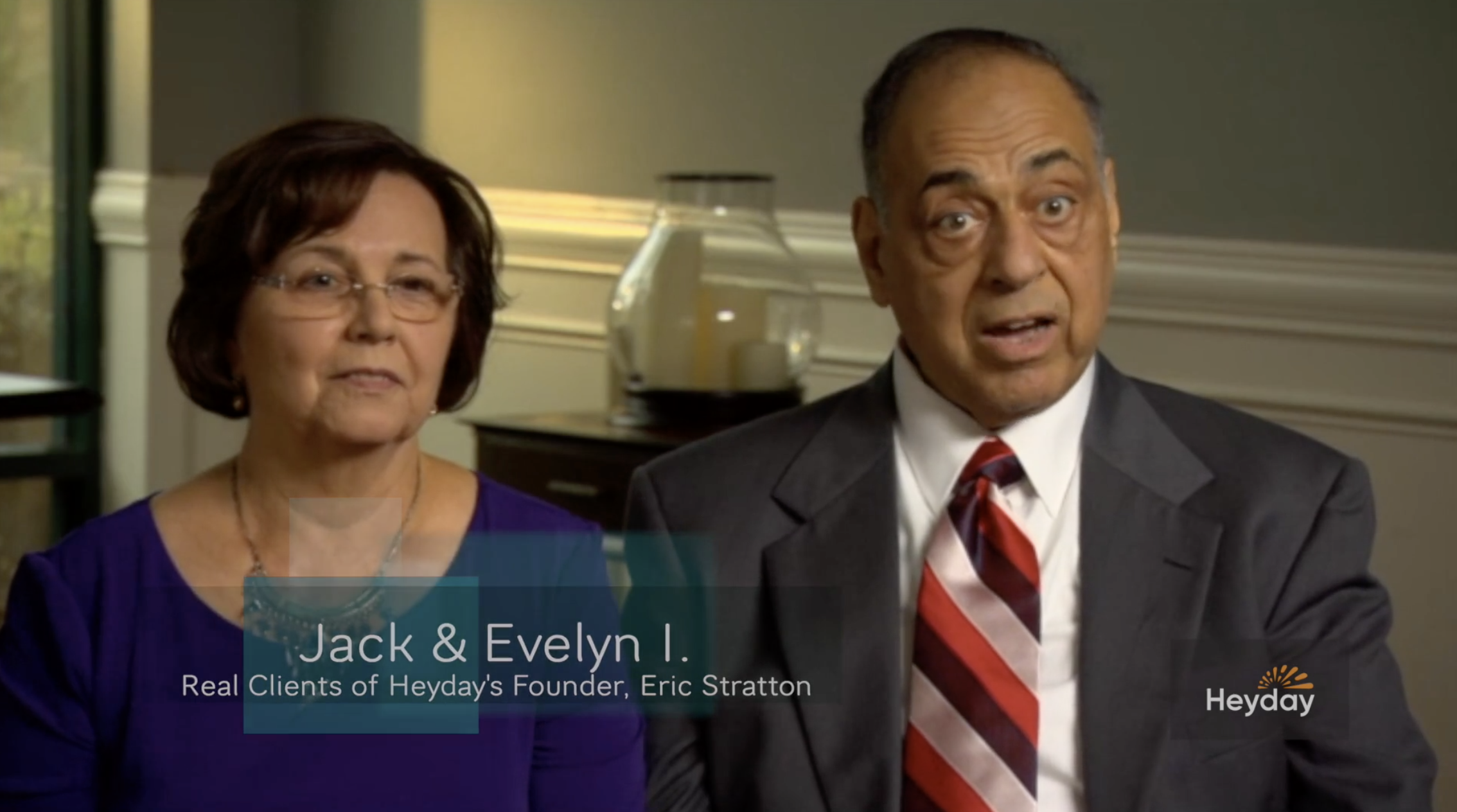

LEARN MOREHeyday’s founding team has helped hundreds of clients reduce risk and protect their retirement income. Here’s what some of them have to say about working with us:

“I’ve known Eric for about nine years. He’s done a wonderful job of handling the money to help me avoid paying unnecessary taxes, avoid market volatility and have an income stream I can count on in the future, no matter what may happen.”

“Since we’ve been here, we’re so much more relaxed. No matter what the market does, we can sleep at night and not worry.”

We develop unique tools to help retirees price — and plan for — the key challenges they may face that could derail retirement. With close partnership with scholars, economists and authors, we also created a free content library of informative e-books and videos.

Published:Aug 28, 2013 6:15 a.m. ET

Financial issues in retirement can be different too. Whether you are single, married, divorced or widowed, women face unique financial concerns in retirement.

Published:Nov 21, 2017, 08:00am

Most of us dream of living a nice, long retirement during which we can enjoy time with family, relax and not have to worry about waking up to an alarm clock every day.

Published:Jul 11, 2013 at 12:26 PM

Financial issues in retirement can be different too. Whether you are single, married, divorced or widowed, women face unique financial concerns in retirement.

Important news, article, and updates for retirees.

Heyday Retirement is a premier source for comprehensive tools and informative content designed to help retirees secure a custom retirement income plan. This plan is the foundation for living out the retirement of their dreams — a retirement that is truly their Heyday! Learn More

How much does the Heyday app cost?

The Heyday app is completely free. There are no monthly fees or signup fees; no credit card is required. This means you can create a full retirement income plan in Heyday and pay nothing unless you decide to purchase some or all of the insurance products suggested in the plan.

*Fixed index annuities are not a direct investment in the stock market. They are long term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed index annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for additional optional benefit riders or strategy fees associated with allocations to enhanced crediting methods could exceed interest credited to the accumulation value, which would result in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

Materials offered by Heyday Retirement, including articles, ebooks, and workshops are designed to provide general information on the subjects covered. They are not intended to provide specific financial, legal or tax advice. Heyday markets insurance products and its representatives do not give investment, legal or tax advice. You are encouraged to consult your tax advisor, attorney, or investment advisor.

By contacting us or submitting your contact information, downloading booklets, or attending workshops, Heyday may refer you to our licensed insurance professionals who may contact you to offer a meeting to discuss how insurance services can help meet your retirement needs. You may withdraw your consent anytime.

All Heyday authors, professors and educators are paid for their contributions. Their inclusion does not represent an endorsement of products.

Copyright 2021 Heyday. All rights reserved.