Retirement Risk #4: Canceled Plans — Addressing a Subtle Risk

The transition to retirement can be tricky for many, as spending discretionary income we can’t make back seems risky.

How can retirees spend on the fun stuff without jeopardizing the rest?

Cancelling or postponing fun retirement plans may seem like an obvious move.

“After experiencing the early years' income deficits, we tend to cut spending on things we hoped to enjoy, such as travel. This puts these goals at risk. While we may be able to afford to spend later in retirement, our health and other factors may be a hindrance.”

— Eric Stratton, Heyday founder

It can be common for retirees to experience an income deficit in retirement early on, where expenses outweigh monthly income, the prudent thing to do is often to cut discretionary spending. Sometimes this reduction is supposed to be temporary until Social Security, pensions, or Medicare eligibility kicks in.

If this postponement of “fun” spending goes on for too long, it may pose lasting impacts in retirement.

First, by delaying those trips and activities we’d always looked forward to, we may miss out on doing them in our most mobile years of retirement. As we continue to grow older, our health naturally declines, which can impact whether we end up doing the fun things on our list.

Second, these delays can become a habit early in retirement due to more money going out than in. Even if we hit full retirement age or start receiving additional income many years later, we may still be in conservative mode when it comes to our money. The result? Possibly more canceled plans.

For Most Retirees, Mobility Has a Use-By Date

Renowned retirement author and Heyday Contributor, Tom Hegna breaks retirement into three phases:

- Go-Go Years - we’re very active in retirement, full of energy to pursue travel, golf, cruises and hobbies.

- Slow-Go Years - we physically can do everything we could in the go-go, but we just don’t feel like it.

- No-Go Years - we probably don’t leave the house due to declining health and mobility.

When we keep canceling plans, the calendar on our Go-Go Years keeps turning. The risk is that we may find ourselves in the Slow-Go or No-Go Years without ever taking that trip of a lifetime we worked so hard for throughout our careers.

Consider this example:

Don and Cathy retired when he was 62 and she was 63. They’re drawing her Social Security benefit while letting his payout grow until he reaches his full retirement age at 65.

While still getting used to retired life, the couple constantly worries about money, uneasy after seeing their income drop to only her Social Security check each month.

As a result, they aren’t spending any money on travel or dining out. They also canceled their trip to Iceland. Instead, they spend their days doing yard work and their nights in front of the TV – meaning retirement isn’t living up to what they imagined.

Both of them feel unsatisfied, restless and are starting to gain weight. What should they do?

- Dip into their nest egg and start enjoying the hobbies and travel they planned? What if they spend their savings down too quickly?

- Keep putting off those plans for three more years until Don is 65? Will they feel like going then?

- Should one go back to work for a few more years so they’ll have more retirement savings? Since Cathy is already drawing Social Security, there are caps on what she could make without affecting her monthly benefits.

If Don goes back, they face the same “letting the Go-Go-years pass them by” issue they’re currently dealing with, except they can still grow their retirement account.

The truth is, none of us know or can control what will happen in retirement — when we’ll get sick, when a spouse may pass away, when the stock market will be up or down. And when we keep postponing our plans for this reason or that, someday can eventually become never.

Fortunately, there are steps retirees can take now to help plan for a more financially secure retirement (which could free them up to keep their plans early on).

Understanding how well their nest eggs may hold up against key retirement risks can be a great place to start.

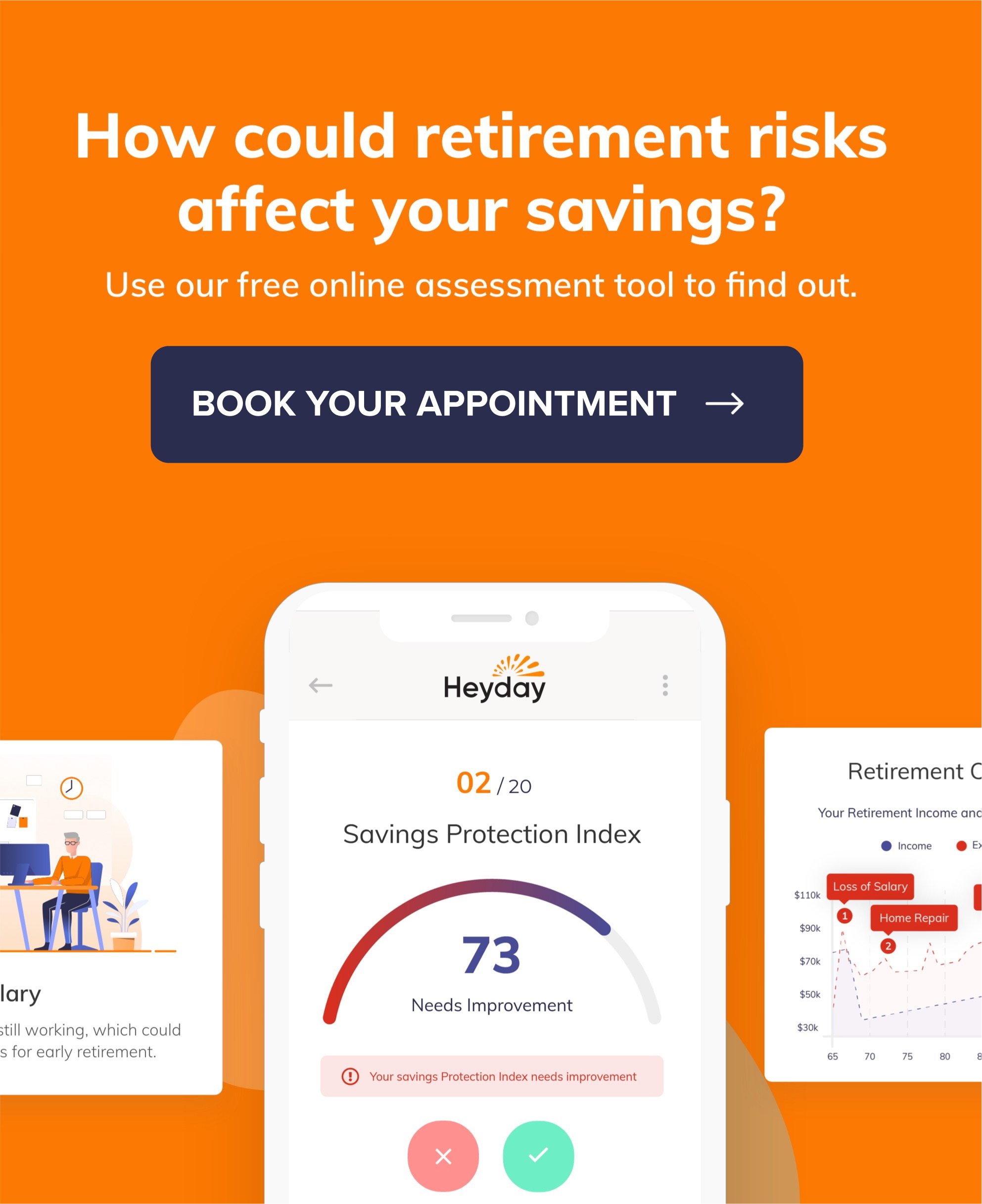

Free online tools like Heyday’s Custom Retirement Review allow retirees to quickly assess where they stand.

Answer a few simple questions and see how at-risk your retirement savings may be using this free tool here.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.