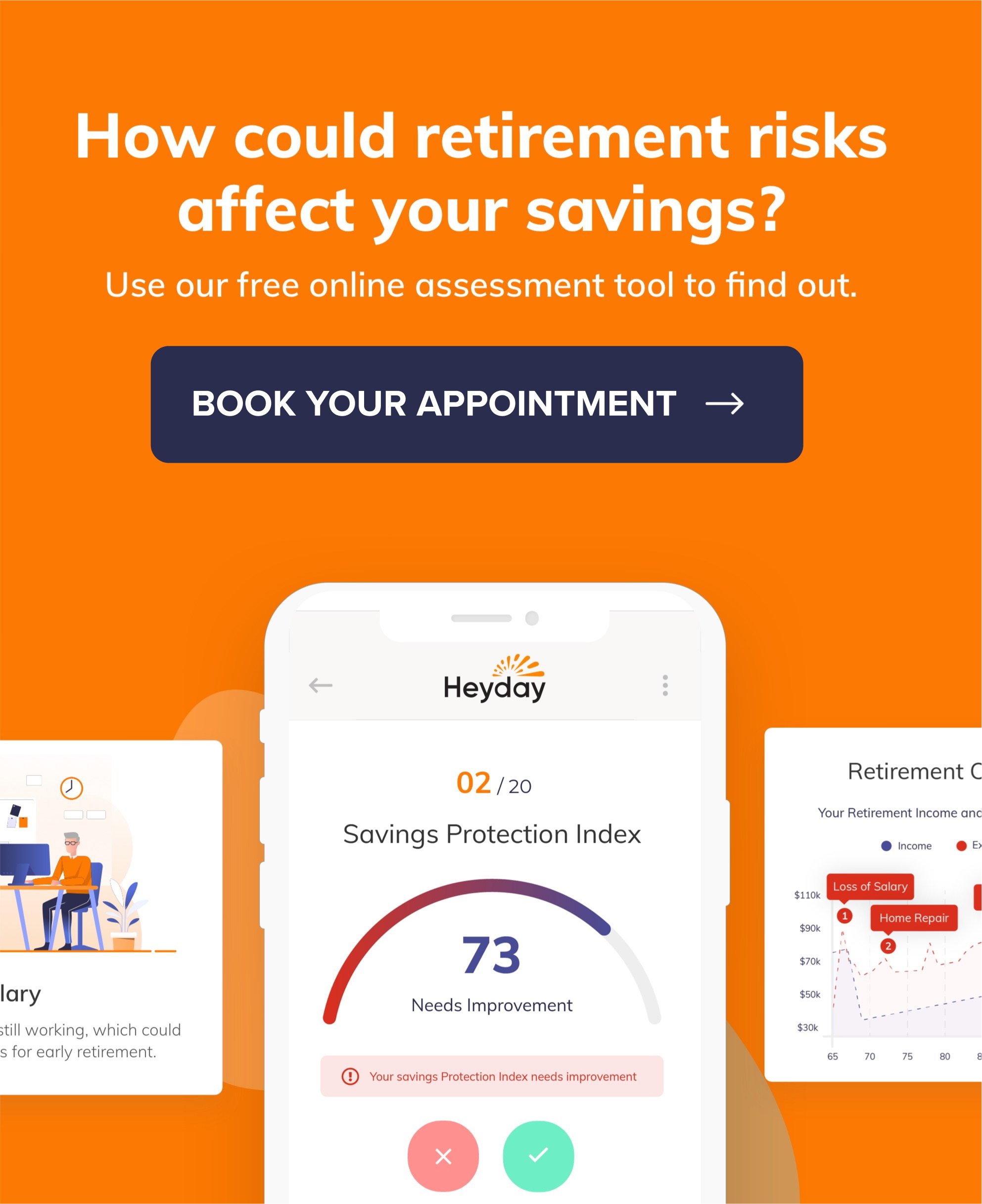

Retirement Risk #2: Salary Dependence — When Spouses Stagger Timelines, Trouble May Follow

Marriage May Be Less Blissful When Only One Retires

It’s not uncommon for one spouse to retire before the other does. However, this situation could create relational and financial challenges.

There may be several scenarios where one spouse retires before the other, including:

- Desire to retire

- Job loss or layoff

- Age differences

- Declining health

- Eligibility of Social Security or pension

“After a spouse retires, the other spouse often continues to work to provide the household with a stable income. This salary reduction can result in losing some of the most active retirement years.”

— Eric Stratton, Heyday founder

When one spouse retires, compromises may need to be made, as both parties adjust to the new routine and monthly budget.

Potential drawbacks for the retired spouse:

- Loss of social network / connections in the workplace

- Potential to develop unhealthy habits

- May apply pressure to working spouse to retire

- Has to wait on spouse’s approved vacation time to travel

Retiring to the couch and TV while waiting for your spouse to come home may not be the ideal situation for most retirees. It could lead to boredom, weight gain and lack of motivation to leave the house for fun activities when the working spouse is available for such events.

Potential drawbacks for the working spouse:

- Pressure from retired spouse to retire sooner than desired

- Relationship stress — from the division of household duties to budgeting

- Feeling the burden of providing the sole family income

Imagine getting up early, rushing through the morning routine and putting in a full day’s work while your spouse gets to sleep in. That has the potential to create tension in even the most rock-solid relationships.

A Staggered Retirement Could Create Salary Dependence

Relational friction aside, there is one additional challenge when one spouse retires and the other one doesn’t: salary dependence.

When one spouse retires and the other doesn’t, couples could fall into the salary dependence trap. They still receive the benefit of a predictable monthly paycheck and manage their finances accordingly.

However, the working paychecks can turn from a crutch into a real stumbling block for determining when the other spouse should leave the workforce. As couples estimate their expenses and retirement income without the working spouse’s check, the gap between what’s coming in and going out each month may make it seem impossible for the other spouse to retire.

This salary dependence can often result in the working spouse delaying retirement, which in turn could mean delaying taking those trips, pursuing those fun activities together and ultimately enjoying their most mobile and active retirement years.

It’s difficult to put a price tag on that lost time. But to quote ancient philosopher Theophrastus, “Time is the most valuable thing a man can spend.”

Consider this example:

Sharon and James can’t seem to agree on when James should retire. She’s 70 and has been retired for six months. He just turned 65, loves his job, and is adamant about working until at least 67.

While he’s on the job, Sharon spends hours online shopping, which puts a dent in their one working income. Then, when James gets home, he’s too tired to even go out to dinner. Imagine how many arguments may arise while the next two years go by.

While the situation will be different for every couple, there are steps they can take now to plan ahead and help prepare for a staggered retirement.

Online risk assessment tools like Heyday’s Custom Retirement Review help retirees determine how long their retirement savings may last when facing the challenges some retirees must navigate.

Ready to see where your retirement savings stand against the risks you’re concerned about? Find out for free by answering a few simple questions here.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.