Retirement Risk #17: Aging at Home — The Potential Costs of Staying Put

Challenges & Opportunities for Retirees Who Want to Stay in Their Homes

Aging in place is something many retirees want, but does it make sense from a cost perspective?

Here are some things retirees should consider before committing to a plan.

According to AARP, approximately 90% of adults 65 or older want to age in place throughout retirement.

There could be several benefits associated with staying put in retirement, including:

- Maintaining familiar surroundings

- Sentimental value, especially if one spouse has passed away

- Staying close to current neighbors and friends helps combat depression and cognitive decline

- Could be cheaper than an assisted living facility

- For some, being able to keep home in the family and pass it down to loved ones

And now, during the midst of the coronavirus pandemic, retirees and their families have additional motivations for finding alternatives to long-term care and assisted living facilities.

Yet, there are many costs to prepare for and think about, especially ensuring you can still safely live in your home.

“It's hard to fathom having to leave the security of our homes in our later years. The costs associated with preparing our home for aging in place can be higher than expected.”

— Eric Stratton, Heyday founder

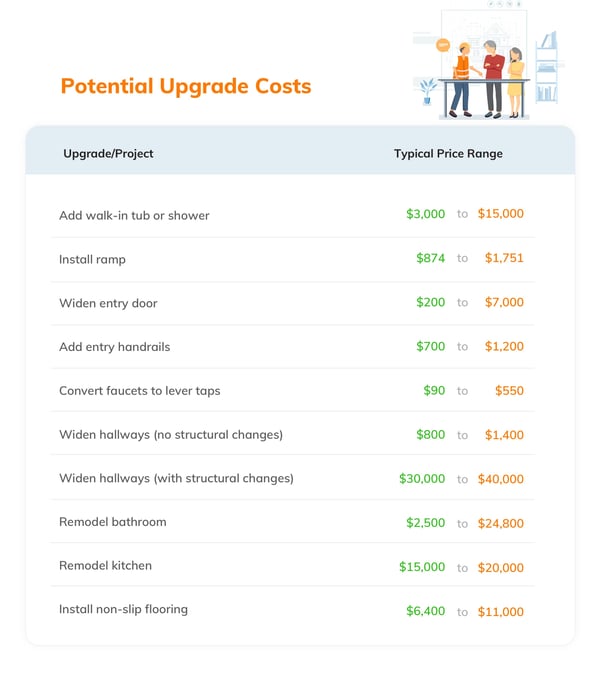

Average Costs of Accessibility Upgrades

When considering aging in place, think about every room in your home and how it may need to be upgraded to ensure a safer living situation if you were bound to a wheelchair. In one Demand Institute study 27% of boomers in one recent survey stated the home where they plan on aging in place is accessible for those with disabilities or special needs.

Here are some accessibility upgrade price ranges to give you an idea of what the costs may be.

While making home upgrades is top of mind for many, other factors could be challenging to handle later.

Additional Aging in Place Costs

At some point, you may reach an age where living 100% assistance-free is no longer an option due to declining health or mobility. While staying in your home can provide a host of mental benefits, there could be additional costs that go beyond home renovations for accessibility.

Some examples include:

Homemaker services - as we grow older, we may need help with some of the everyday chores around the house, like cleaning and cooking meals. Homemaker services fill these needs for age in placers, but they likely won’t be cheap. According to Genworth’s 2019 Cost of Care Survey, the median national cost of homemaker services was $4,290 a month, or $41,480 a year.

Home health aides - similar to homemaker services, home health aides assist with daily activities like bathing and dressing. However, they do not administer any medications or health services. The median cost for a home health aide is $4,385 a month, or $52,620 a year.

In-home skilled nursing care - assistance with medications and other medical needs can be a whole different category. And the national median rate for in-home skilled nursing care is $87.50 per visit. Think about having to have multiple visits if you need medication administered more than once a day — that could run approximately $5,250 each month, or $63,000 a year.

As you can see, these costs have the potential to erode retirement savings. But not all of them may be required in your situation. It’s wise to plan for them when aging in place, just in case — which can make retirement planning more challenging.

How Aging in Place Can Pose Challenges in Retirement Planning

Of course, the decision to age in place is different for everyone, with several factors coming into play:

- Your current health

- Whether or not relatives live nearby

- Size of your home and yard

- Proximity to groceries and medical care

Speaking with family and an experienced professional can be an excellent way for retirees to think through all the costs before committing to staying put.

How do pre-retirees and retirees handle the potentially high price of aging in place?

- Delay retirement - working a few more years can add some cushion to the nest egg. But, it also may have the hefty price tag of our most active retirement years — the ones where we still have energy to take trips and enjoy hobbies.

- Take on debt - some retirees may want to pay for these upgrades with a loan or credit card. The total costs of financing these upgrades could significantly increase, depending on the interest rate. The more debt retirees have the less they have to spend each month on living expenses and activities.

- Withdraw from retirement savings - for most of us, the idea of taking on debt could cause even more anxiety about future costs. To address this, some will take a large lump sum from their retirement accounts. This approach not only lowers their lifetime income potential, it also can have negative tax implications that could be avoided.

- Take out a reverse mortgage - a reverse mortgage is one way retirees can tap into their home’s equity to age in place. A word to the wise: if you are unable to remain in the house due to long-term care needs, the mortgage becomes due. Plus, once you pass away, it’s your heirs’ responsibility to pay off the balance, or the house must be sold.

- Move to a more retiree-friendly home - whether it’s a downsize, upgrade, or a lateral move with wider doorways, moving to a new home can be an option. Again, there are pros and cons to taking on a mortgage in retirement, and every retiree’s situation is different.

Consider this example:

Susan, now 63, became a widow in her late 50s. The home she and her husband shared is full of fond memories with their children. Her home is located in an area that has greatly appreciated, as reflected in her property taxes. It also has a pool, which is impossible for her to maintain, and her children live two hours away.

Susan really wants to stay in her home but has crunched the numbers and the costs won’t be something she can spare from her nest egg. What should she do?

#1. Sell the house, and move to be closer to her children? (She doesn’t want to feel like a burden.)

#2. Take out a loan to cover accessibility renovations now? (What if she needs that home equity later to help pay for health and medical expenses?)

#3. Work a few more years to grow her savings? (Susan is so ready to retire from the office politics and long commute.)

None of these decisions are easy or without consequence. In addition to speaking with a financial professional and family members, retirees and pre-retirees can see how aging in place may affect their nest egg with online tools like Heyday’s Custom Retirement Review.

In only a few minutes, retirees can learn their Savings Protection Index — and gauge how well their retirement savings could weather retirement’s challenges. Start here to get your free Custom Retirement Review.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.