Retirement Risk #19: Home Healthcare — An Essential Piece of Aging in Place

What Retirees Could Expect in Home Health Costs

According to AARP, 90% of adults 65 or older want to stay put in retirement, choosing their homes over assisted living or long-term care facilities.

As we age in place and our health declines, we may need home health services to remain independent. However, assistance for essentials like bathing, dressing or running errands could add up quickly. And there may come a time when we need skilled in-home nursing supervision as well.

“Aging at home can be possible up to a point. Planning for this unskilled help should include several thousands of dollars each month on top of normal living expenses like groceries, utilities and the mortgage.”

— Eric Stratton, Heyday founder

It’s no secret that long-term care (LTC) can be expensive, with semi-private nursing home stays averaging around $7,513 per month according to LTC provider Genworth.

To help reduce costs and stay in their homes longer, many retirees may eventually need to rely on in-home health services, including:

- Home health aides - empower retirees to age in place by assisting with everyday activities like bathing, dressing and eating.

- Homemaker services - enable retirees to stay in their homes and remain independent by running errands and doing small chores like cooking and cleaning.

- Skilled in-home nurses - provide medical-related services, such as wound care, rehabilitation or administering medications that require a licensed nursing professional.

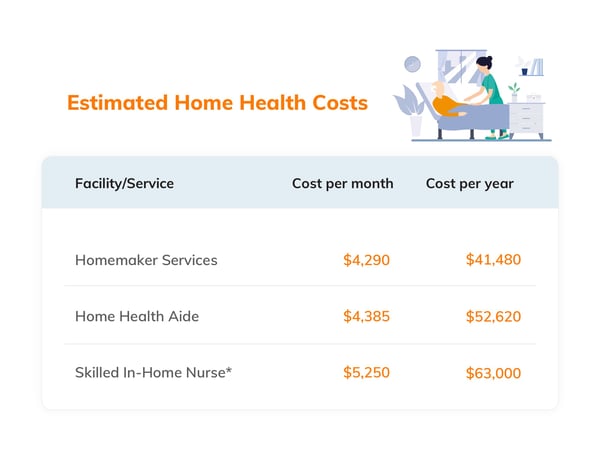

Estimated Home Health Costs

The costs retirees may pay for home health services will depend on a variety of factors, including location, level of care needed and services required. Genworth’s 2019 Cost of Care Survey revealed the following national median costs for in-home care:

Compared to the hefty monthly price tag for a semi-private nursing home stay, in-home solutions can help retirees extend the life of their nest egg. Yet, $4,000+ per month is still a considerable amount for most of us — one that is on top of utilities, groceries and other ongoing household expenses.

How could retirees cover home health costs?

-

Keep working a few more years - delaying retirement could allow extra time to grow your retirement nest egg. But, it could cost us our most active and mobile years — where both spouses are healthiest and could enjoy retirement goals like international travel.

-

Withdraw more from retirement savings - when retirees take additional distributions from their retirement accounts, they could run out of money. And depending on which accounts they draw from, there could be additional tax implications. It’s best to consult with your tax professional regarding your specific situation.

Consider this example:

Pamela, a 68-year-old retiree and widow, plans to stay in her home as long as possible. She built it with her late husband, and it’s a beautiful waterfront home she hopes to pass down to her children. However, Pamela only has a small pension from her husband and her own Social Security check to live off of, plus the $200,000 life insurance payout she received when he passed away.

How could Pamela plan to pay for home health costs?

-

Withdraw more from savings? That life insurance money is dwindling faster than she anticipated. Paying $50,000+ a year for a home health aide could deplete her account in less than four years.

-

Move in with one of her children? She doesn’t want to feel like a burden, and they all have their own families to take care of.

Because none of us can predict what our health will look like in retirement, planning to age in place can be quite difficult. Every decision has the potential to impact our livelihood in one way or another.

The good news is, there are free tools available to help retirees see how their savings may fare against the risks they’re concerned about facing. With Heyday’s Custom Retirement Review, retirees answer a few simple questions and discover their risk exposure.

Ready to see where you stand? Take your free risk assessment here.

*Based on two visits per day at the national median rate of $87.50 per visit.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.