Retirement Risk #8: Emergency Fund for Unknown Expenses

How Old Money Habits Can Serve Retirees Well

How should retirees pay for emergencies? While retirement nest eggs are technically savings accounts, a separate cash cushion can be a good idea for many reasons.

Emergency funds aren’t just for rainy days or periods when we may be in between jobs. They can be an essential ingredient to retirees’ peace of mind well after they leave the workforce.

While they may not need six months of their working income in emergency reserves, having some cash stashed gives retirees options and control for the unknowns that may lie ahead, including:

-

New roof or HVAC

-

Car repairs

-

Kids get into financial trouble

-

Need costly dental work

-

Being underinsured for health care

Without an emergency fund, paying for these unexpected events could quickly erode a retiree’s nest egg. According to a recent Bankrate financial survey, only 41% of Americans could cover a $1,000 emergency with savings.

“Recent events have proven the long-held belief that saving into a substantial and protected emergency fund is vital to the long-term sustainability of our retirement. Monthly saving shouldn’t stop at retirement.”

— Eric Stratton, Heyday founder

Do Retirees Really Need an Emergency Fund?

If a retiree met an unexpected expense without a cash cushion, how would they cover such an event? They may have to choose from less desirable options to cover big-ticket surprises:

- Withdrawing from your nest egg - spending down your retirement savings too quickly can be a real concern (and risk) for retirees. Yet, when unplanned expenses pop up, they may feel their only resort is to take more from their savings. Currently, retirees can probably make penalty-free withdrawals due to coronavirus. Depending on the type of account, there could be tax implications for taking this extra “income.” Speaking with a tax professional is recommended. Retirees could also be subject to additional Medicare costs if their income increases beyond the cap associated with their plan — see Medicare’s specific guidelines for your situation.

- Charging costs to a credit card - most experts would agree that unless you can pay off credit cards immediately after using them, they aren’t an ideal solution for retirees. The more debt you have to pay off, the less monthly income you have for other expenses and activities.

- Tapping into your home’s equity - to cover unplanned costs, retirees could take out a home equity line of credit (HELOC) or home equity loan. However, most lenders have minimum loan amounts, which can range between $10,000 to $25,000. And with repayment periods that can last up to 20 years, retirees could be saddled with an extra bill for decades.

No Emergency Stash = Difficult Decisions

In one example, Amy and Robert retired 11 months ago and are still getting accustomed to their new job-free lifestyle. Over the last couple of weeks, the old “bad things happen in threes” expression became their reality:

- The transmission went out in their car, which is no longer under warranty.

- The roof started leaking in the guest bathroom.

- Days before their children are set to arrive for a family reunion at their home, the AC went out.

The total for addressing all three problems? $5,500.

In addition to the financial costs associated with the actions above, what about the opportunity costs? Chances are, Amy and Robert will skip that trip to Niagara Falls they’d been looking forward to. Or keep putting it off until it’s forgotten.

And all of this is happening just 11 months into retirement. What about any other unplanned expenses that may arise over the next 10, 20 or even 30 years?

If they continued to save just $500 a month in an emergency fund like they did while working, they could’ve paid for these costs without resorting to options with undesirable consequences.

Unplanned expenses are just one of many risks retirees may face in retirement.

Fortunately, there are actions retirees can take now to help minimize risks and preserve their nest eggs. The first step? Calculating their projected expenses and risks in retirement.

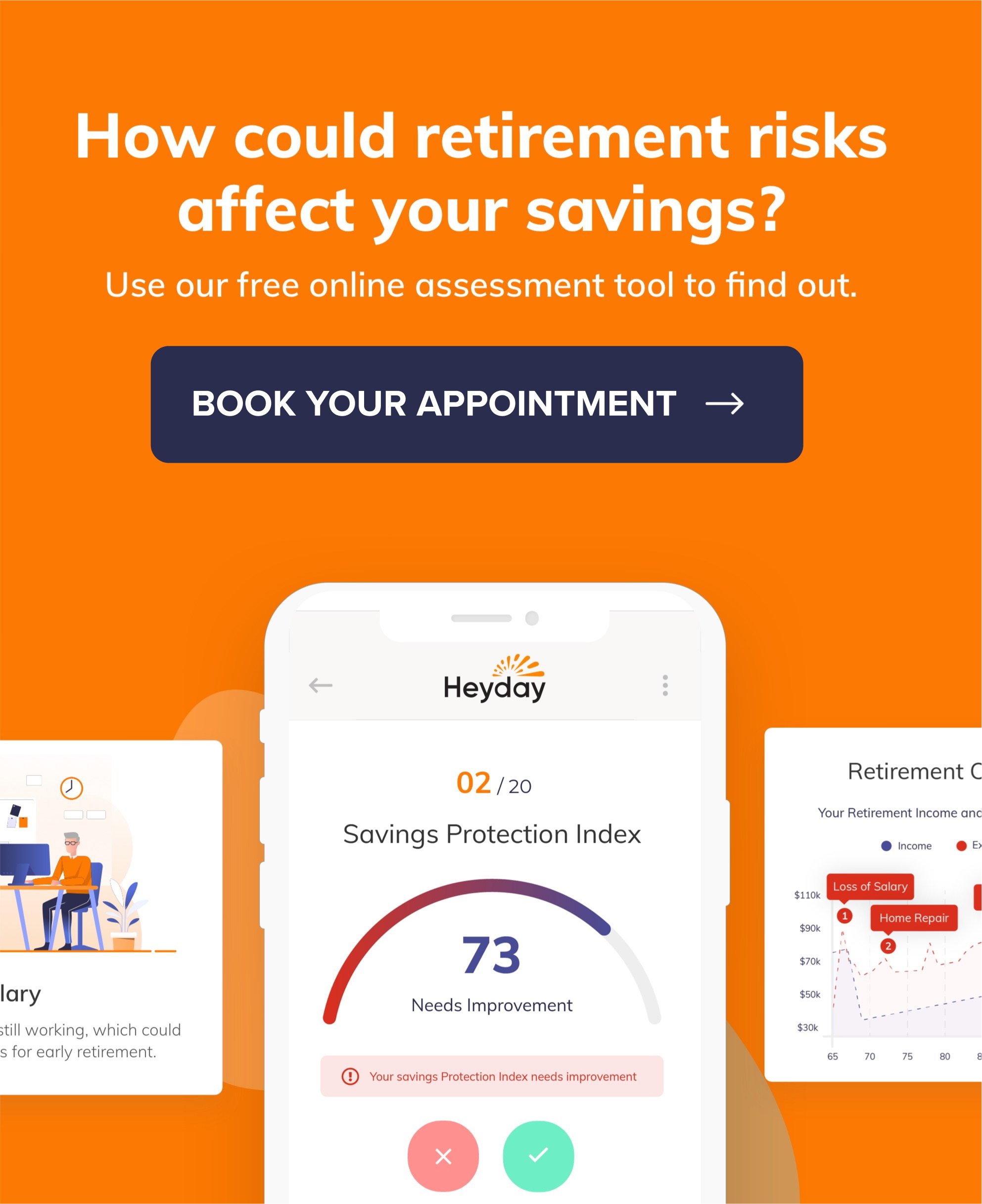

Online tools like Heyday’s Custom Retirement Review can help to empower retirees to get a true understanding of their financial risk exposure in just a few minutes.

Once all their risks and expenses are identified, they can speak with a financial professional about how to revise their strategy and secure their retirement.

Ready to see what your retirement risks look like? Take this free retirement assessment now.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.

%20%20Retirement%20Financial%20Risk%20%238%20Unknown%20Expenses.jpg)