Retirement Risk #5: Economic Uncertainty — Don’t Let it Upend Retirement

The Unknowns in Retirement Can Stump Even the Most Prepared Retirees

The ups and downs of our economy can be challenging for everyone, especially those nearing retirement.

Here’s how to help plan for some of the economic what-ifs in retirement.

When thinking about some of the events that have rocked our economy over the last 20 years, we don’t have to look much farther than the present. Most of us didn’t anticipate a global pandemic in our lifetime. Yet, here we are.

If we keep scrolling back, we can reflect on a recession, housing market crash, dot-com bubble burst, and several natural disasters that impacted our daily lives and investment portfolios.

The sum of all these events reinforces what we already know — we can’t predict or steer the future.

Given the track record of the last few decades, how can retirees help themselves feel adequately prepared for the next 20 or 30 years?

“Economic factors can weigh heavily on our retirement decisions… Tax changes, market volatility, and other circumstances beyond our control can lead to real concerns over running out of savings.”

— Eric Stratton, Heyday founder

Running out of savings is a real concern for many retirees because retirement can be a time of increased financial risks.

Of course, non-retirees aren’t immune to the effects of unpleasant economic trends. Their ability to keep working and earning provides hope and time for a financial rebound when the following occur:

Market Volatility

As long as our nest eggs are tied in the market in retirement, we will continue to experience ups and downs that could impact our finances.

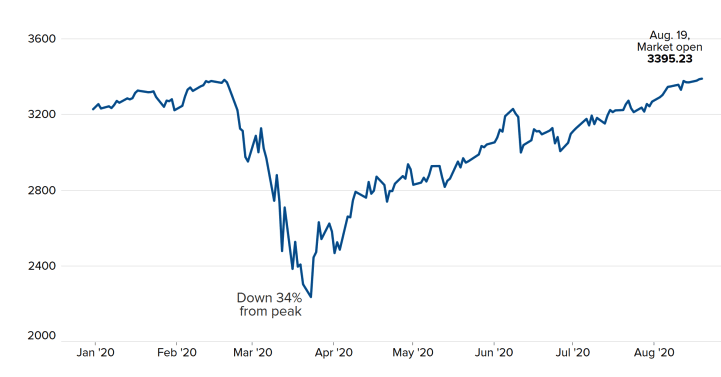

Here’s how the first eight months of 2020 played out for the S&P 500:

The “roller coaster” can work well during our working years, but when we retire, market losses can impact financial outcomes.

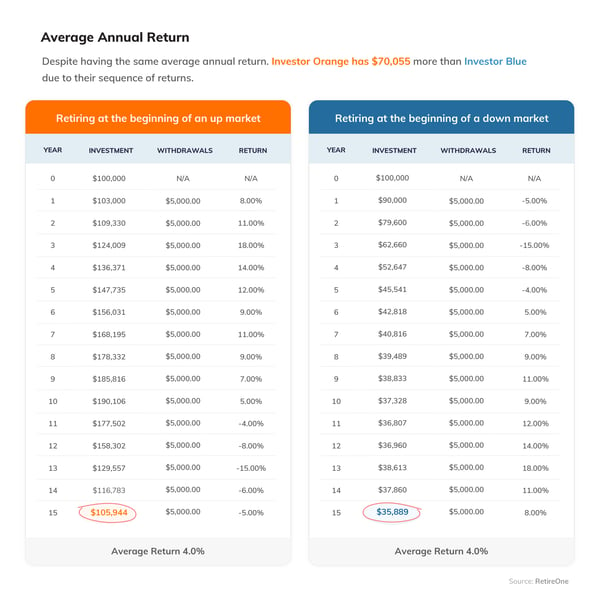

But in retirement, it’s not just about the average return. It’s about the sequence of returns. In the example below, you can see how two different portfolios received the same average rate of return, but with the opposite timing of market ups and downs.

Policy Changes

Assuming current tax laws and government benefits will remain unchanged throughout retirement isn’t a safe bet. Depending on what is happening at the national and local levels, taxes may be increased or decreased. Consulting with your tax professional should be part of your retirement strategy.

You’ve no doubt read the headlines declaring Social Security’s funding issues. While the solution has yet to be delivered, it could include an increase in taxes, a decrease in Social Security benefits, or a combination of the two.

There’s also a concern about how to pay for the coronavirus relief initiatives, which the U.S. has already committed to spending $2.4 trillion. Questions loom about the how and who of footing the bill, which could push the national debt to levels not seen since World War II.

No matter what happens next, the economy will likely be impacted in ways we don’t have a say in.

Common Retirement Concerns, Now Amplified

Even when times are “normal,” these economic unpredictables can occur. Now that we are currently in a global pandemic, many may be left feeling helpless. Some retirees may feel the need to adjust their original retirement plans to accommodate this uncertainty. So, they try different approaches to help alleviate their concerns, including:

Delaying Retirement

Fear of running out of money often causes retirees to work longer than they planned. While this approach can provide some additional income and savings, it may not be without consequences.

Retirees postponing their biggest retirement goals while spending their healthiest years on the job can mean those plans and trips may not get taken. And if they’re married, the health of their spouse may also determine when and if they can enjoy those activities later in life.

And there’s also the possibility that working longer won’t be an option. According to Aegon’s 2020 Retirement Readiness Survey, 37% of retirees worldwide had to leave the workforce earlier than they planned due to health issues, job loss, or other factors.

Eliminating Some of Their Lifelong Retirement Goals

As we near retirement, the dreams we’ve had all those years have price tags associated with them. Uncertainty about what the future market conditions or government regulations will look like can give retirees pause on pursuing the things they may have looked forward to.

For example, Jack and Barb are planning on retiring when they both turn 65 later this year. They had what they believed was a solid retirement plan, and were ready to finish their final months of work.

The stock market is more volatile than it has been in years, and concerns about their retirement have already set in. Every day, they peek at their investment statements and become more concerned. They have to do something, but what?

Should they both keep working another five years?

Should they retire as planned, but only live off Social Security (which will barely cover their monthly living expenses)?

Should they move to a faraway island where living is cheap, but they’ll never see family?

Should they downsize and move out of the home they love?

None of those options are what they envisioned retirement would or could be.

The good news is, there are steps pre-retirees and retirees like Jack and Barb can take now to help plan for the uncertain economic road ahead.

First, they should consider calculating how well their current retirement strategy incorporates economic unknowns and other risks. Online assessment tools can be a great way to gauge how well retirees have accounted for the what-ifs detailed in this article.

To see how retirement risks could affect your finances, try this free online assessment tool.

The good news is, there are steps pre-retirees and retirees like Jack and Barb can take now to help plan for the uncertain economic road ahead.

First, they should consider calculating how well their current retirement strategy incorporates economic unknowns and other risks. Online assessment tools can be a great way to gauge how well retirees have accounted for the what-ifs detailed in this article.

To see how retirement risks could affect your finances, try this free online assessment tool.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.