Retirement Risk #20: Heirs — Balancing Legacy & Retirement Spending

Leaving a Legacy vs. Enjoying Retirement: It Doesn’t Have to be One or the Other

There’s nothing wrong with wanting to leave money to those you care about — whether the beneficiaries are family members or organizations. However, some retirees may struggle with how much they can comfortably spend and still leave something behind.

“Many retirees desire to leave a financial legacy for the next generations. This can sometimes result in reducing the enjoyment of our own retirement. While this may not be a risk to your finances, it can be a risk to your ability to live the retirement that you hoped for.”

— Eric Stratton, Heyday founder

U.S. Inheritances by the Numbers

United Income’s 2019 white paper, “Inheriting Retirement Security: How Inheritances Help Households Afford Retirement” reports:

- Retirees are expected to transfer $36.2 trillion to their families, charities, and other beneficiaries over the next 30 years.

- An estimated 1 out of 5 households will receive a transfer of wealth.

- More than 25% of inheritances go to adults 61 or older.

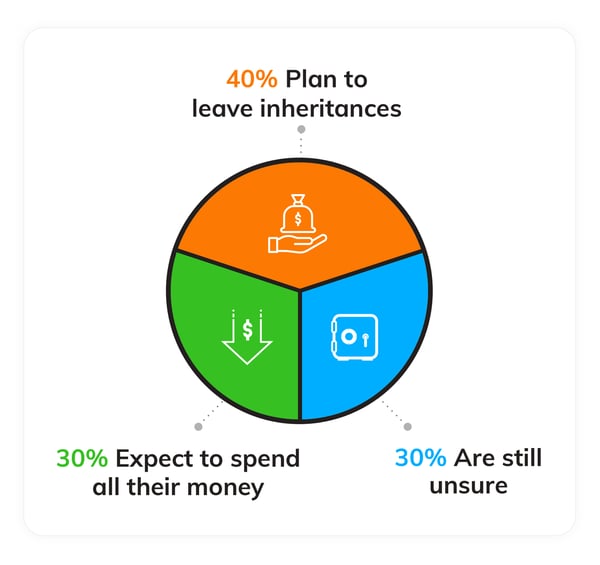

According to Funding Life After Work: Impact of Parenthood & Wealth Transfer on Retirement Solutions for Baby Boomers, a Hearts & Wallets report focused on adults in their 50s and 60s with $500,000 or more in investable assets:

Leaving a Legacy May Complicate Retirement

Participants in the Hearts & Wallets research revealed the majority fear running out of money. Yet, those who are certain they want to leave a legacy are scared of running out.

It’s that fear of running out that could lead to retirees underspending — and under living their own retirement to leave something behind.

Unfortunately, without a plan on how to leave a legacy, retirees may default to not spending any money aside from necessary expenses in an attempt to prolong your nest egg for your beneficiaries.

That isn’t the retirement lifestyle most look forward to when putting money aside every month for all those working years.

Another potential risk? The inheritance recipients do not know what to do with the money when they receive it. Without a certain level of financial literacy, they may fall victim to “Sudden Wealth Syndrome.” You’ve likely heard stories of people who won the lottery or experienced a windfall only to quickly spend it without much to show for it.

It would be a shame if retirees worked their whole lives, then scrimped and saved throughout retirement only to leave behind a legacy that was lost in the blink of an eye. Without proper planning, it could happen. Research by The Ohio State University found that 1/3 of people who received an inheritance had negative savings within two years.

Consider this example:

Edward and Cindy are 64 and about to retire. They have one adult daughter, Julie. Because Julie is a single mother, the couple feels very strongly about leaving a significant financial legacy for Julie and their only grandchild. Like most retirees, they spend their whole careers envisioning the trips they’d take and adventures they’d share once finally retired.

Because the market is down, they’re already concerned about making their money last through retirement. Cindy already planned a two-week European cruise for fall of 2021. What should they do?

The good news is, proper planning can help retirees like Edward and Cindy cross more retirement goals off their list while knowing what they may leave behind for family members.

It all begins with evaluating how far your nest egg may go when you factor in leaving a legacy as well as other retirement expenses. Free online risk assessments like Heyday’s Custom Retirement Review empower retirees to understand how their savings may be at risk by answering a few simple questions. From there, they can speak with a financial professional to revise their plans to feel confident about facing retirement’s unpredictable ups and downs.

Ready to determine your retirement risks? Try Heyday’s free online assessment here.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.