Retirement Risk #1: Loss of Income — A Common Roadblock for Retirees

How Not Planning for This Reality Can Complicate Retirement

The transition into retirement can shake the most well-prepared retirees. And coming face to face with a loss of income isn’t for the faint of heart.

Without proper planning, this abrupt drop-off in income can lead to unpleasant consequences.

— Eric Stratton, Heyday founder

While our daily routine changes considerably the day we retire, so can our relationship with money.

Instead of a well-oiled monthly financial routine centered on predictable monthly income, we could receive a bank statement with the total our life savings on it (and no instructions on how to live off of it).

Lump Sums Pose Challenges

We’re all creatures of habit, especially when it comes to our money. That’s part of the reason so many retirees struggle with living off their nest eggs.

- Making a lump sum last is something many of us have never had to do. Think back to those first paychecks of your career. Once you got into the swing of things, you knew you could rely on that predictable income every month. We used our monthly income as guardrails we could use to plan, spend and save — knowing exactly how much we had to work with.

- It doesn’t feel good to spend down our savings. Throughout our careers (and maybe even sooner), most of us have been taught that savings are for emergencies, and never to be spent on everyday expenses.

- There are too many unknowns to make confident decisions. Aside from the initial changes of not receiving a paycheck and having to spend down our savings, there are other factors that can make this more difficult than people know until they’re going through it. The catch-22 goes something like this:

You don’t know how much you can safely spend.

You don’t know how long you need the money to last.

The financial moves you make going forward could impact your lifestyle — and livelihood — in retirement. It’s a heavy responsibility most of us would pass on given the choice.

According to the 2019 Aegon Retirement Readiness Survey, only 16% of Americans would prefer to receive their retirement savings as a lump sum upon retirement. Yet, 100 million of us contribute to defined-contribution plans that will ultimately become lump sums the day we retire.

Using these plans throughout our careers to grow nest eggs isn’t the issue — it’s what retirees do when faced with an income loss that can be the stumbling block.

Consider this example:

Bob retires from a utility company after 30 years. With no pension and a retirement savings of $400,000, Bob and his wife are experiencing the shocks of a loss of income and the unfamiliarity of managing a lump sum.

Here are some of the questions running through their minds as they determine how to best manage this lump sum:

How long will our money last?

What if there’s a recession or market crash?

What if there’s an emergency?

What will happen if we run out of money? Will we have to live with our kids?

How long will we live? What if we plan to 87 and one of us lives to 97?

Even if Bob and Mary followed the 4% Rule, and only withdrew $16,000 each year from their nest egg, they still couldn’t be certain they’d have enough later in life due to inflation, market volatility, and not knowing how long they need their savings to last.

Plus, a closer look at the average Social Security benefit doesn’t add much in the way of confidence. As of January 2020, the average monthly payout was $1,503.

Initial Changes of Loss of Income Can Have Lasting Impact

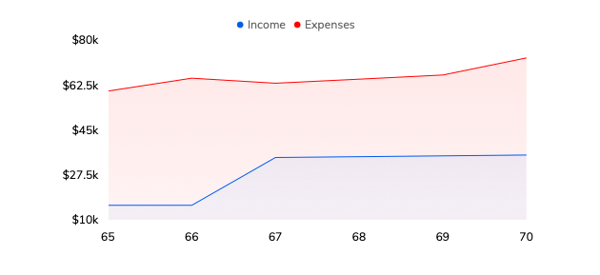

Using the Bob and Mary example from above, would Social Security be enough to cover their basic expenses they wouldn’t have to tap into their nest egg? Would it be enough to help them do the things they’ve always wanted?

Chances are, they would try to use as little of their savings as possible, leaving the rest for any financial surprises and rising costs they may encounter later in life.

But what about that safari or Mediterranean sailing trip they always planned? Underliving in retirement can be just as costly as overspending. It’s not the kind of retirement any of us want to experience.

Fortunately, there are steps retirees and pre-retirees can take now to help them face a loss of income with confidence.

The first step retirees may want to consider is to determine how this and other risks may affect their retirement. Online retirement assessments are a quick and easy way to see how their income and expenses align with their goals and potential risks.

Ready to see where your retirement stands? Take our free online assessment here.

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.