7 Ways Retirement 'Paychecks' Empower Retirees

There’s a lot of information out there about the many benefits of guaranteed retirement income, which include:1

- Protection from outliving your money, or longevity risk

- Helping to provide peace of mind

- Being better able to budget

Not surprisingly, predictable retirement income is one thing some of the happiest retirees have in common.2

But when retirees take withdrawals from their nest eggs or investments, that income is not guaranteed, nor does it provide all the extra benefits that help ensure they attain their ideal retirements.

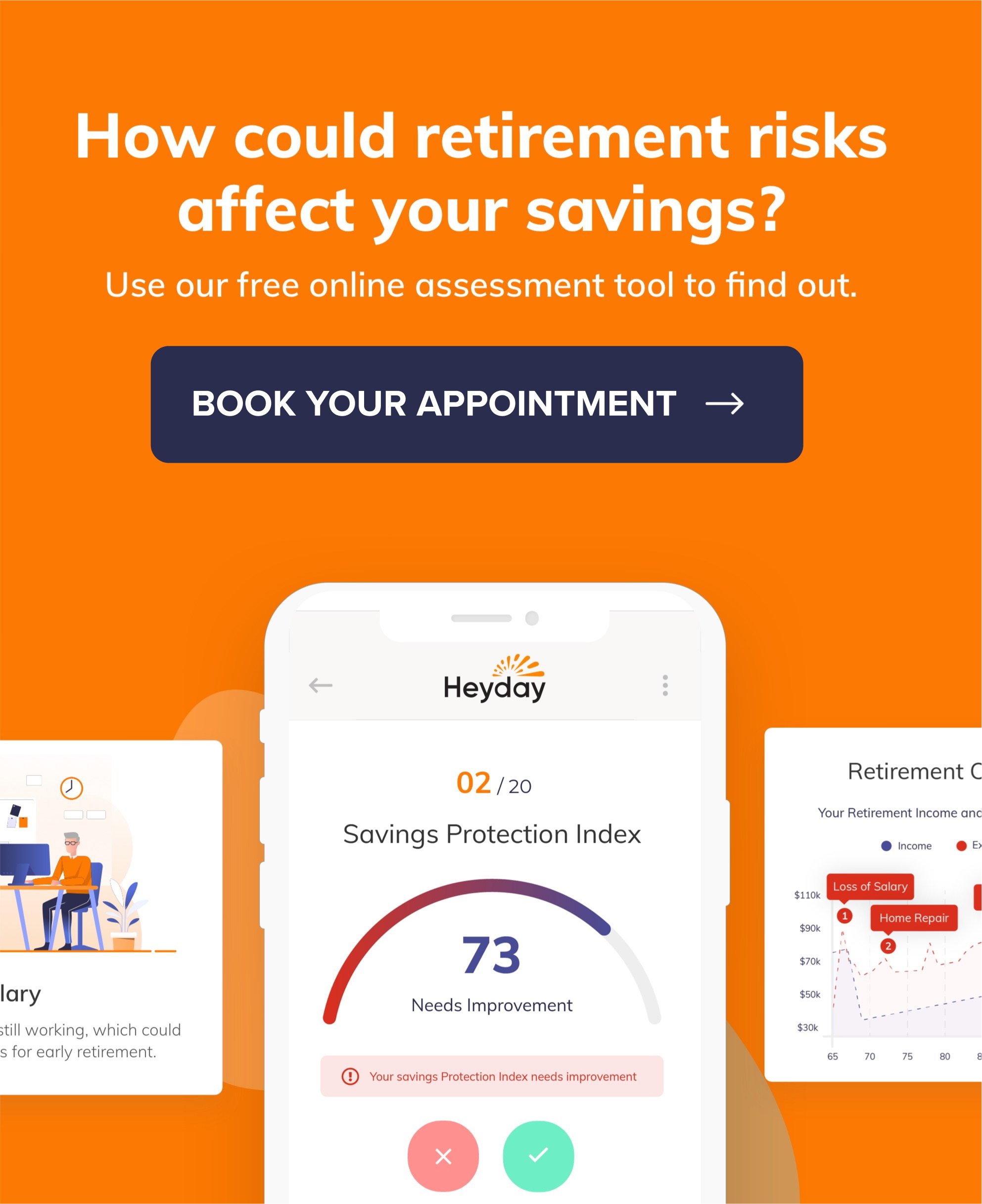

The free Heyday app helps retirees convert a portion of their assets into fixed-indexed annuities so they can receive monthly income that’s guaranteed, no matter how long they live.

Guaranteed income = “paychecks” for life + so much more

These guaranteed “paychecks” do more than cover basic expenses. They help retirees:

1. Eliminate key financial risks, especially the risk of running out of money. Unlike 401(k)s and other investments, the Heyday app uses fixed-indexed annuities* to generate retirement income. These insurance products aren’t subject to a loss of premium due to market downturns, and they also help to gain control over deflation risk, sequence of returns risk, as well as withdrawal rate risk.

2. Enjoy retirement now, while they are most active. One of the reasons retirement can be so challenging is because it’s hard to spend money on fun activities today when we don’t know what tomorrow will bring. With a retirement income plan, retirees know exactly what they have coming in month after month so they can spend their most mobile retirement years doing what they’ve always dreamt of.

3. Remove the financial pressure of managing a lump sum. Most of us have never had to make a lump sum last, and it’s especially difficult when we have no idea how many years we’ll need it. Heyday’s retirement income plans empower retirees to keep managing their money the same way they did while working, using a monthly income and expense approach they have grown accustomed to over decades.

4. Helping to feel confident they can live comfortably throughout retirement. When retirees build an income plan using the Heyday app, they can accurately forecast their goals, challenges and living expenses in detail. But they also factor in inflation, so they can feel good about maintaining their retirement lifestyle 2, 5, or 25 years in the future.

5. Budget and save for big-ticket items, just like those working days. Heyday’s income plans are built around each retiree’s specific goals and challenges, so they can allocate funds for future expenses, large and small. They also have the flexibility to save for future goals and challenges using the income and expense approach and earmarking savings, just like they did during their careers.

6. Help address long-term care. Many retirees are concerned about the possibility of having to spend time in a long-term care facility. With a Heyday retirement income plan, they can earmark retirement savings just in case they end up needing long-term care. Plus, the insurance products Heyday recommends include a nursing home confinement waiver that can allow additional penalty-free access to the funds for any use if qualifying conditions are met.

7. Continue providing for one spouse if the other passes away. If married retirees choose an income rider in their retirement income plan, typically the surviving spouse may keep receiving income as the beneficiary.**

Retirement income helps to provide enough to cover expenses in any given month — it helps remove the risks and challenges that can keep retirees from attaining their ideal retirement lifestyle.

We only get one retirement, and at Heyday, we want retirees to make it the absolute best it can be.

If you’re concerned about outliving your money or like the idea of having a guaranteed monthly “paycheck,” no matter what the market does, use the free Heyday app to create your custom retirement income plan.

Want to see a sample retirement income plan before trying the Heyday app? Start here.

Sources:

1http://greenwaldresearch.com/wp-content/uploads/2018/03/2018-GLIS-Factsheet.pdf

*Fixed-indexed annuities are not a direct investment in the stock market. They are long-term insurance products with guarantees backed by the issuing company. They provide the potential for interest to be credited based in part on the performance of specific indices, without the risk of loss of premium due to market downturns or fluctuation. Although fixed-indexed annuities guarantee no loss of premium due to market downturns, deductions from your accumulation value for additional optional benefit riders could under certain scenarios exceed interest credited to the accumulation value, which would result in loss of premium. They may not be appropriate for all clients. Interest credits to a fixed index annuity will not mirror the actual performance of the relevant index.

**Terms vary by annuity contract. See the Education section of the Heyday App for details of your specific retirement income plan.

Create your retirement "paychecks" for life:

Try the Retirement Income Planner App

BOOK YOUR APPOINTMENT

Written by Cindy Collins

Forbes Contributor & Retirement Financial Professional

Cindy Collins is a Heyday Retirement contributor with over 30 years of experience in personal financial services.

About Heyday

Heyday is a premier source for comprehensive tools and informative content designed to help retirees build a secure retirement income plan.

Subscribe

Stay in the know on a wide range of retirement topics.