The Heyday app is completely free. There are no monthly fees or signup fees; no credit card is required. This means you can create a full retirement income plan in Heyday and pay nothing unless you decide to purchase some or all of the insurance products suggested in the plan.

The security of your personal information is a top priority. Heyday implements and maintains a host of security procedures to protect your information from unauthorized access, destruction, use, modification, or disclosure. Here’s how:

To learn more, please read Heyday’s terms of service and privacy policy.

Additional restrictions may apply based on available assets and financial product requirements.

If you’re a U.S. citizen who lives outside of Florida, we may be able to assist you through one of our partners.

Please contact Heyday Retirement for additional information.

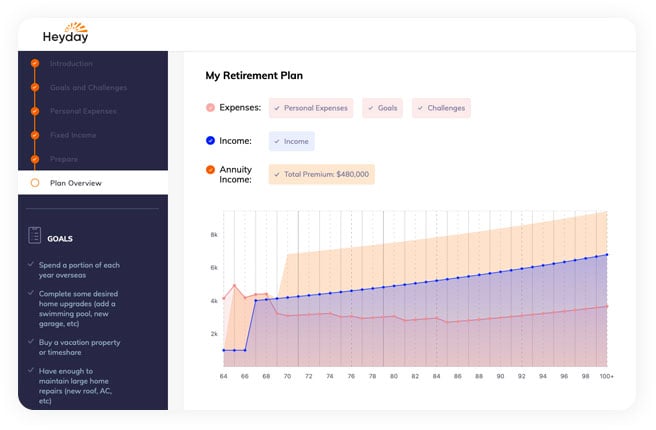

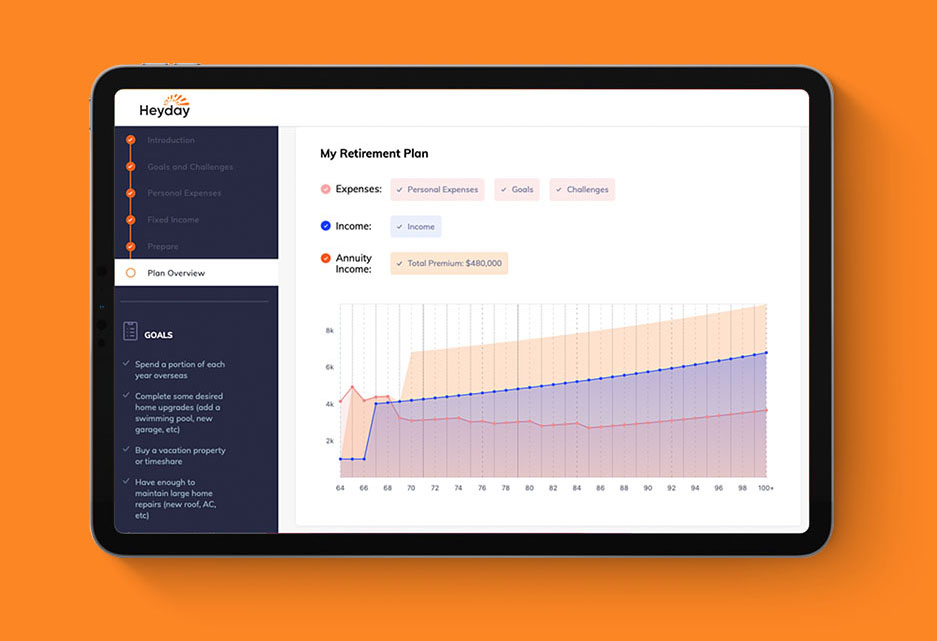

Visit the Heyday app to get started and create a free profile. Videos and interactive components will guide you step-by-step through the process to help identify your retirement goals, challenges, recurring expenses and even the income you’ll have from Social Security, pensions and other sources.

All of this information is used to design an actionable retirement income plan tailored to your unique wants, needs and financial situation.

There are many ways to reach out with questions on the retirement income planner app:

Monday through Friday during regular office hours of 9:00 - 5:00 EDT.

utilize the chat window on the Heyday website and app

You can complete the Heyday app over the course of days or weeks, or build your plan in one sitting it’s totally up to you.

To complete the entire process, you will need to provide thefollowing information:

The app will also walk you through your goals, plus any challenges you’d like to plan for in retirement.

Since Heyday’s retirement income plans are tailored to your specific goals and finances, it’s important to be as accurate as possible.

This custom plan is meant to be an actionable roadmap to helping you attain your unique retirement goals and includes “buckets” of funds designated for the activities you’d like to prepare for.

The Heyday team has been helping retirees and pre-retirees secure their retirement financial strategies since 2001. The lessons learned over the past 17 years are the guiding principles used in the Heyday approach and algorithm we use to create custom retirement income plans.

Take Heyday's free online retirement income planner for a spin to help secure the funds you need for the next chapter you really want!

Try The Free Heyday App Now

Published:Aug 28, 2013 6:15 a.m. ET

Financial issues in retirement can be different too. Whether you are single, married, divorced or widowed, women face unique financial concerns in retirement.

Published:Nov 21, 2017, 08:00am

Most of us dream of living a nice, long retirement during which we can enjoy time with family, relax and not have to worry about waking up to an alarm clock every day.

Published:Jul 11, 2013 at 12:26 PM

Financial issues in retirement can be different too. Whether you are single, married, divorced or widowed, women face unique financial concerns in retirement.

Heyday Retirement is a premier source for comprehensive tools and informative content designed to help retirees secure a custom retirement income plan. This plan can be the foundation for living out the retirement of their dreams — a retirement that is truly their Heyday! Learn More

How much does the Heyday app cost?

The Heyday app is completely free. There are no monthly fees or signup fees; no credit card is required. This means you can create a full retirement income plan in Heyday and pay nothing unless you decide to purchase some or all of the insurance products suggested in the plan.

Materials offered by Heyday Retirement, including articles, ebooks, and workshops are designed to provide general information on the subjects covered. They are not intended to provide specific financial, legal or tax advice. Heyday markets insurance products and its representatives do not give investment, legal or tax advice. You are encouraged to consult your tax advisor, attorney, or investment advisor.

By providing your information, you give consent to be contacted by a licensed insurance professional about the possible sale of an insurance product. Pay nothing unless you decide to purchase some or all of the insurance products suggested in the plan. You may withdraw your consent at any time.

All Heyday authors, professors and educators are paid for their contributions. Their inclusion does not represent an endorsement of products.

Copyright 2022 Heyday. All rights reserved.